Your 2024 Austin Home Buying Insights-The Spring Market is Here!

Mar. 06. 2024

Ashley Here! (And so is Spring)!

Dear valued readers, whether you’re joining me for the first time or you’ve been part of our journey for a while, welcome! If you’re familiar with my YouTube channel, or Insta account you know I’ve spent considerable time discussing Real Estate and more recently, the dynamics of selling in the vibrant Austin market. This month, however, I’m shifting gears to explore the other side of the coin: home buying in Austin, TX. From understanding housing prices and interest rates to navigating taxes and inventory levels, let’s dive into what prospective buyers can anticipate in this bustling city.

**Inventory Insights**

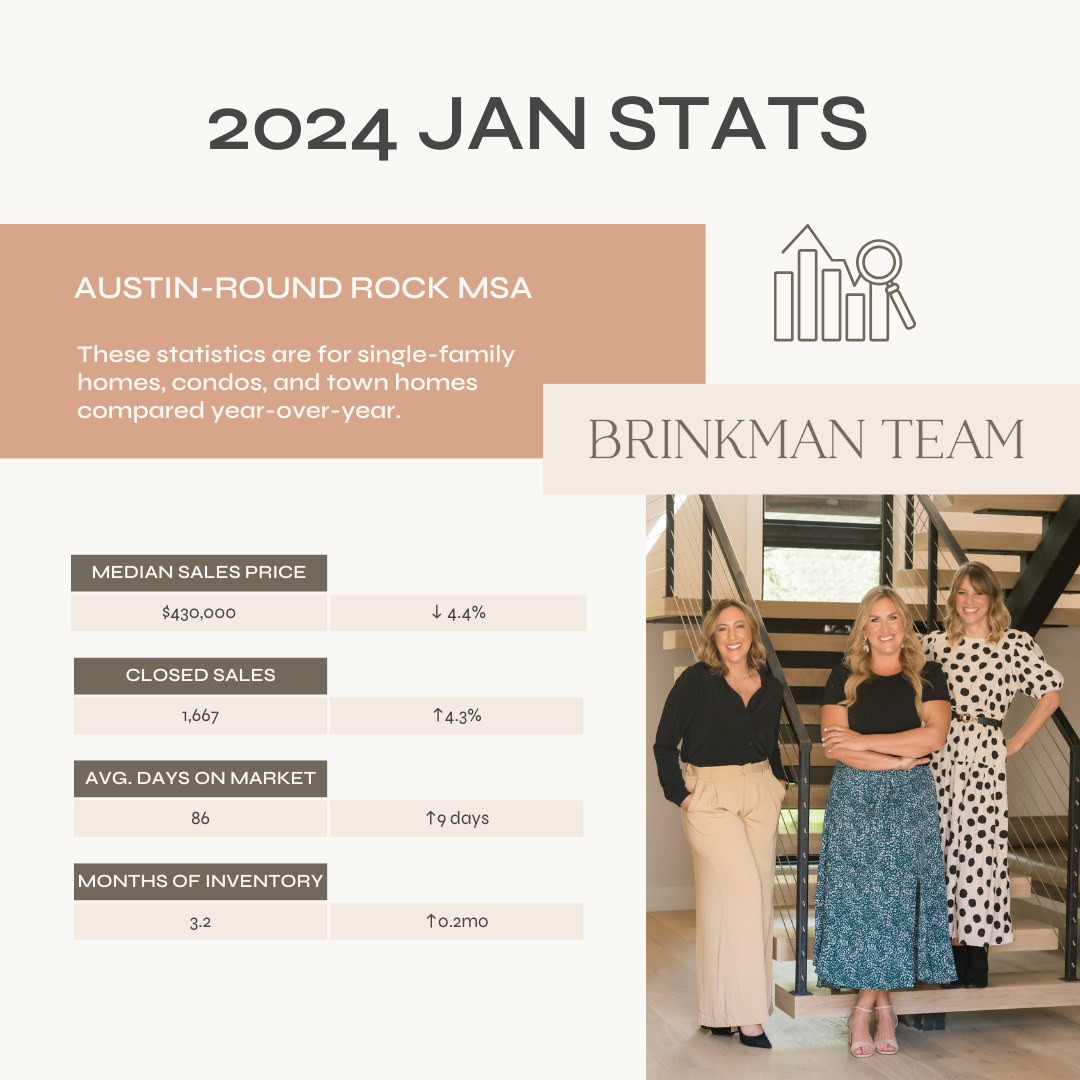

Let’s start with a critical factor: inventory. In real estate, inventory refers to the current supply of homes available for sale, measured by how long it would take to sell them all if no new homes were listed. Imagine you’ve begun your home search, consulted with a lender, and have a clear picture of your budget. When you zoom in on a specific neighborhood, if homes seem to be selling the moment they’re listed, that’s a sign of low inventory. This scenario demands quick action to secure a home that fits your needs. Currently, Austin boasts under four months of inventory (see above stats from January)—a figure significantly lower than the six months considered balanced for both buyers and sellers. In my nearly 15 years specializing in Austin real estate, I’ve yet to see this equilibrium achieved, highlighting the city’s enduring appeal and the persistent demand outpacing supply.

For those looking to buy, adopting a hyper-local strategy is key. Certain neighborhoods in Austin are highly sought after, and when a well-priced, move-in-ready home hits the market, being prepared to make an immediate offer is crucial. Conversely, areas with a glut of new construction may see slower sales, presenting a different set of considerations and opportunities, especially when builders offer incentives.

**New Construction and Builder Incentives**

Reflecting on the recent past, the market saw unprecedented demand, with waitlists extending into the hundreds and builders often retracting offers due to the sheer volume of interest. This frenzy, coupled with historically low interest rates, is behind us. Today, buyers can look forward to builder incentives that might include covering closing costs or offering interest rates below the current market average. These incentives make entering the Austin market more accessible, especially for those looking to invest in new construction. Some builders may also offer additional perks, such as design incentives or discounts for early engagement, varying throughout the year.

**A Word of Caution on Insurance Rates**

Insurance is an often-overlooked aspect of homeownership that can significantly affect your monthly expenses. The recent years have seen the insurance industry grappling with losses due to natural disasters and inflation. As a result, expect to budget at least $150 monthly for homeowners insurance. Special considerations may apply if you’re purchasing in more remote areas, where some insurers may be hesitant to provide coverage. Early comparison shopping for insurance can prevent surprises down the line.

**Understanding Property Taxes**

Texas is notorious for its high property taxes, a crucial factor to consider in your budgeting process. When evaluating potential homes, pay close attention to the county’s valuation and the applicable tax rate, as these can greatly influence your monthly payments. While I won’t delve into tax protests or the benefits of homestead exemptions here (you can find more on that topic on my YouTube channel), it’s important to be aware of these factors as they can have a significant impact on your financial planning. More HERE if you want to dig into this topic!

**The State of Interest Rates in 2024**

Interest rates have been a hot topic, reaching heights in 2023 that have challenged affordability. However, the landscape is changing, with rates beginning to decline, encouraging more buyers to enter the market. It’s important to understand that interest rates respond to broader economic trends and predictions, often fluctuating with the market’s ebbs and flows. As we approach key economic meetings and political events, such as elections, historical patterns suggest potential rate decreases. However, my advice to buyers remains consistent: rather than attempting to time the market, focus on what you can afford and be ready to act when the right opportunity presents itself.

Let me take it another step further–Are you a Buyer who needs their equity from their current home to purchase?

If you find yourself in the unique position of needing to sell your current home to fund the purchase of your next one, you’re not alone. This scenario presents several viable strategies, each with its own set of advantages and my team and I help people achieve this goal repeatedly.

**Purchasing Before Selling**

For those who have the financial flexibility and have received a pre-approval from a lender, I often advise focusing on purchasing your new home first. This approach can simplify timelines and reduce stress, as selling your property is generally easier when it’s vacant (especially if you have kids, pets or a lot of “stuff”). However, if this isn’t feasible for you, consider listing your home during the peak market months of April to June, when buyer interest and inventory levels typically increase.

**Recasting Your Mortgage**

A recast offers an interesting approach for buyers. This involves purchasing your new home and, after selling your current one, using the proceeds to adjust your mortgage. This recalibration can secure your interest rate while potentially lowering your monthly payments, making it an attractive option for those who can manage a down payment and wish to sell their original home later.

**Exploring a Bridge Loan**

Bridge loans provide a temporary financial bridge, enabling you to purchase your next home before selling your current one. While this option offers immediate liquidity, it comes with specific requirements and fees, so it’s important to understand the details before proceeding.

**Leveraging a Home Equity Line of Credit (HELOC)**

For long-term homeowners with substantial equity, a HELOC can be a strategic tool. It allows you to tap into your home’s equity for various purposes, including the purchase of your next property. This option is especially worth considering if rental income from your current home can cover both the mortgage and the interest on your HELOC, potentially enabling you to retain your property as an investment. Before you take this approach chat with me first–there are some stipulations to consider and I have a few lenders who can help with this (more on my YouTube about HELOCs HERE)

Ultimately, navigating the simultaneous process of buying and selling requires a realistic approach. It’s challenging to time the market perfectly to buy at its lowest and sell at its peak, especially within a short timeframe. My advice? Move forward when you’re financially ready, the timing is right for you, and you’ve found a property that meets your needs. Sellers-here are my top tips HERE!

Regarding market timing, experience shows that while the best deals can often be found between November and February (I talk about this HERE), a wider selection of homes usually becomes available in the spring. For sellers, especially those in sought-after school districts, listing between April and June can be advantageous. Remember, the real estate market is active year-round, with transactions happening every day.

Embarking on the home buying or selling journey is a significant endeavor, and while my social media channels are rich with tips and insights, there’s unparalleled value in personalized guidance. I encourage you to reach out and schedule a conversation with us today to explore how we can support your unique real estate goals. We start with a quick phone call, then an in person or virtual meeting!