Brinkman’s Refinancing 101: First Steps to Refinance Your Home

May. 16. 2020

Hey there! I hope you’re staying safe (and healthy!) and enjoying time at home with your family.

While there is a lot of uncertainty surrounding the coronavirus, one thing is absolutely certain – interest rates are crazy low! They are so low I decided to take advantage and refinance another one of my properties and, while doing so, I jotted down some notes to help you do the same.

Why should you refinance?

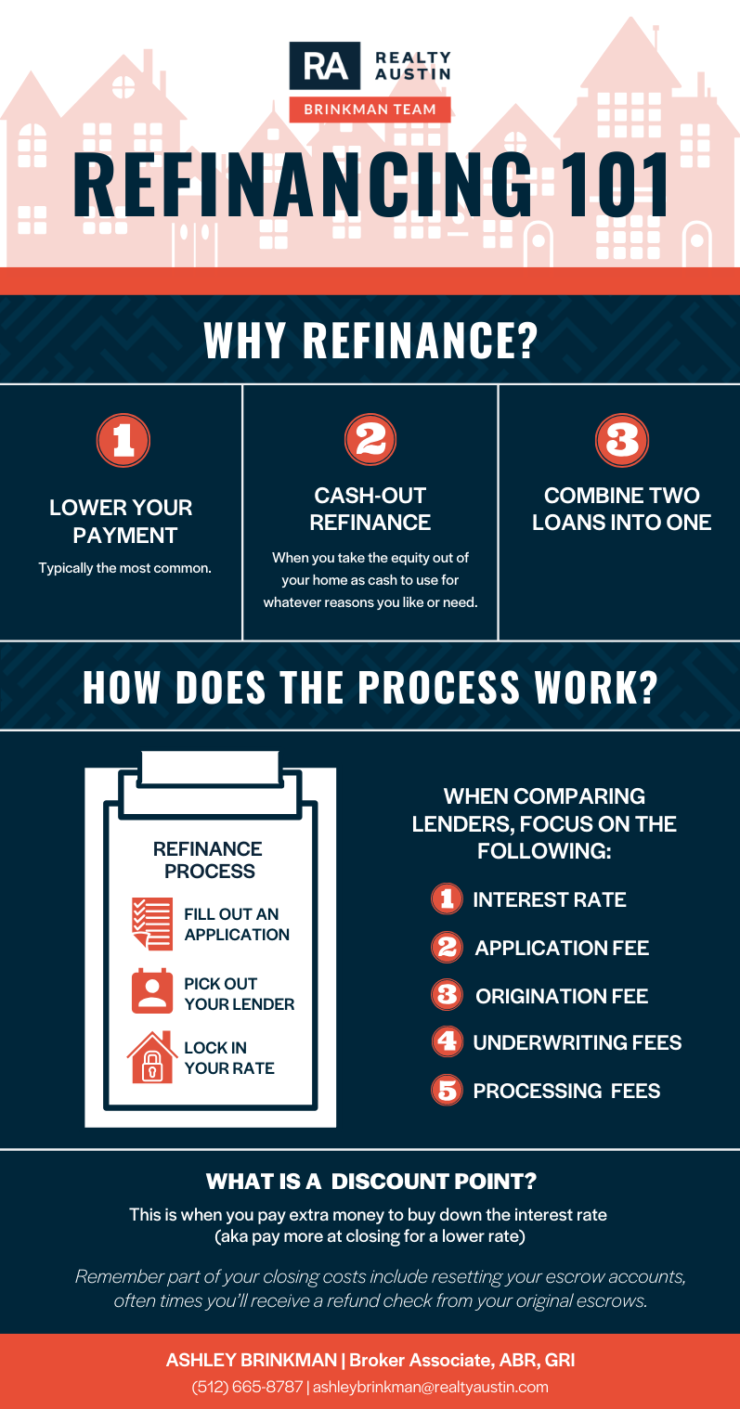

I’ve found there are three main reasons:

- Lower your monthly payments. This is the most common (and popular) reason.

- Cash-out refinance. This is when you take the equity out of your home. You can use this money for anything: home improvement projects, down payment on another house, etc.

- Combine two loans into one.

Before you get started, just know that rates are better on a primary home than they are for any investment property!

How does it work?

Once you’ve decided to refinance, start filling out applications, choose a lender, and lock in your interest rate. Keep in mind; all lenders have different fee structures. Property taxes and insurance will remain pretty consistent, but other payments will vary. What you really want to pay attention to is your principal payment and interest rate. Then, when comparing lenders, focus on their different fees: application, origination, underwriting, and processing. These will vary from lender to lender. Be sure to shop around to ensure you’re getting the best deal!

You can also pay extra money to lower the interest rate. This is called a discount point. If you have the money, don’t forget to bring it up with your lender. It’ll lower your monthly payments even more!

Lender? Check. Interest rate locked in? Check. What’s next? You may have to have your home appraised. But, it depends. The lender will sometimes waive the appraisal if you have enough equity in the property. In the case you’re on the cusp, they might. As I said, it depends. The only time it doesn’t is if you’re refinancing an investment property. In that case, they will always order an appraisal.

Are you simply trying to get your mortgage insurance to drop off? You might not have to refinance. If you have a good rate, you may just need a new appraisal. (This means you need to contact your lender and schedule an appraiser, but be sure to check online first for similar homes to yours that would prove you now have 20% equity).

Here’s a video recap of basically what I told you above:

You can also find more home buying, selling, and real estate tips on my YouTube Channel.

Hit me up if you have any additional questions!