Protesting Your Property Taxes-The 2019 Edition

Apr. 11. 2019

One of my goals this year is to be of more value to my past clients, and while I am always happy to answer what I can, refer recommendations, give my advice and share what I learn about my experiences etc, I seem to be mediocre and distributing this information…

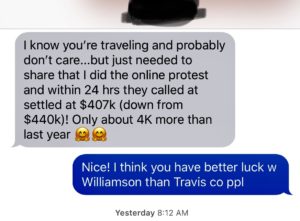

So I am going to do my best to tell you how to protest your property taxes here. May take a little reading, but I will say my past client (in Williamson County) texted me recently and said she saved a lot of money on her taxes and she does what I told her to do years ago–which is the following advice below:

OPTION 1: Protest Your Taxes On Your Own

STEP 1: You will get your tax valuation in the mail. If you have not yet, sit tight, it will be arriving soon. (*Note you can also check the tax county’s website, sometimes it posts there before you receive notice*) Once received you will go to your county’s website to protest.

STEP 2: To see your home’s value (if you are a past client you should already be receiving monthly market updates from me) or you can use our Home Valuation Tool

You can also make an account on our website, and search for similar homes to yours that have recently sold, to help protest the higher value–> But be sure in fact the comparable properties support this. **If you are using our website you have to be sure you verified a password to have access to the sold data**(This is because Tx is a non-disclosure state)

STEP 3: You submit your protest online and the county will respond with a counter or acceptance. You can choose to accept their counter. If you do not like their new appraised value, then you can go to a formal hearing. Be sure your evidence supports your proposed value. If you go to a formal hearing, you print your comparable properties, get a time and fight your taxes in person.

OPTION 2: Hire A Professional To Protest Your Taxes for you

I opted for this Option last year and used Five Stone (I have two clients that work for them) so naturally have to give a shout out! I saved about $40k in property taxes and paid $280 to do so. To me, it was worth it.

Other options:

- O’ Conner Associates

- Texas ProTax

Typically when you hire a professional you are only charged for a portion of what you save. If the company fails to save you money and protest your taxes successfully, then you owe nothing.

Here are the county’s websites for your protest:

**Deadline for Filing is May 5**

Also, a reminder you need to file your homestead exemption if you have yet to do that as well! Be sure your driver’s license address matches the property address you are homesteading.

P.S.S-If you are noticing that your taxes went up significantly, your escrow may have a shortage, so be sure to pay a little extra, your lender is usually the last to know and keep up with this!

Happy Adulting!

-Ashley